If you’re wondering, “Can I use FSA for dental crowns?” then you’ve come to the right place. We’ve got all the information you need to know about using your FSA (Flexible Spending Account) to cover the cost of dental crowns. So sit back, relax, and let’s dive into this topic together.

When it comes to dental expenses, FSA can be a lifesaver. But what about dental crowns? Are they covered? The short answer is, it depends. Dental crowns are often considered a necessary dental procedure, especially when it comes to restoring damaged teeth. However, the coverage may vary depending on your specific FSA plan and the guidelines set by your employer. So, let’s explore the ins and outs of using your FSA for dental crowns and find out if it’s a viable option for you.

Can I Use FSA for Dental Crowns?

Dental crowns are a common dental procedure used to restore the shape, size, and appearance of damaged or decayed teeth. They are typically made of porcelain, ceramic, or metal, and are designed to fit over the entire tooth, providing strength and protection. Many people wonder if they can use their Flexible Spending Account (FSA) to pay for dental crowns. In this article, we will explore the use of FSA funds for dental crowns and provide you with the information you need to make an informed decision.

Understanding Flexible Spending Accounts (FSAs)

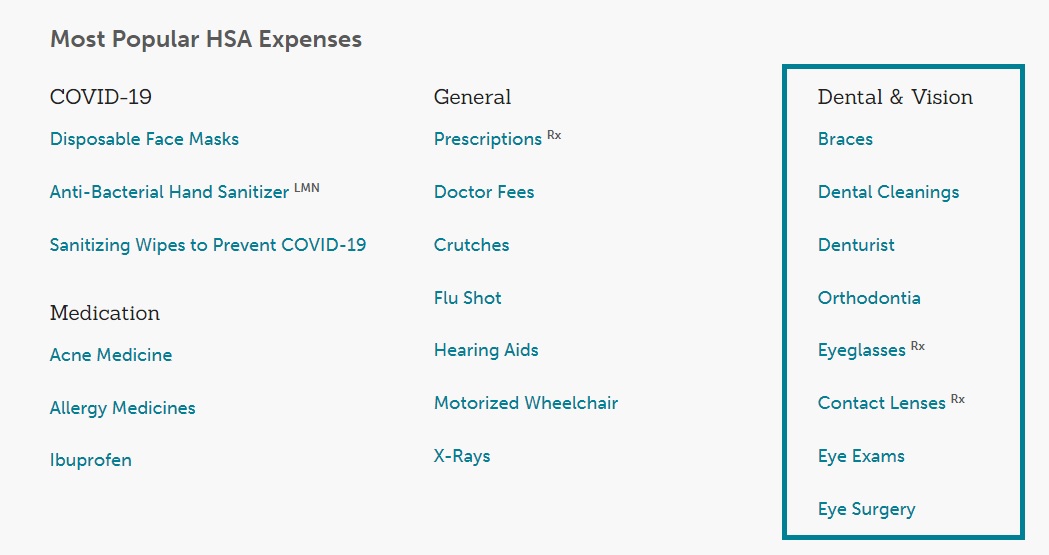

Before we delve into whether you can use your FSA for dental crowns, it’s important to understand what an FSA is. A Flexible Spending Account is a tax-advantaged savings account offered by employers that allows employees to set aside a portion of their pre-tax earnings to pay for eligible medical expenses. These accounts are typically used to cover out-of-pocket medical expenses that are not covered by insurance.

FSAs are a great way to save money on healthcare expenses because the funds contributed to the account are not subject to federal income taxes, social security taxes, or Medicare taxes. This means that you can save up to 30% on your eligible healthcare expenses by using an FSA.

Using FSA Funds for Dental Crowns

Now that we have a basic understanding of what an FSA is, let’s explore whether you can use FSA funds to pay for dental crowns. The short answer is yes, you can use your FSA to cover the cost of dental crowns. Dental crowns are considered a qualified medical expense under IRS guidelines, making them eligible for FSA reimbursement.

However, it’s important to note that not all dental procedures are eligible for FSA reimbursement. Cosmetic dentistry, such as teeth whitening or veneers, is typically not covered. But restorative dental procedures, like dental crowns, fillings, or root canals, are generally eligible for FSA reimbursement.

Benefits of Using FSA for Dental Crowns

There are several benefits to using your FSA funds to pay for dental crowns.

Firstly, by using pre-tax dollars to cover the cost of your dental crowns, you can save a significant amount of money. This can help alleviate the financial burden of the procedure and make it more affordable for you.

Additionally, using your FSA for dental crowns allows you to take advantage of the tax benefits associated with these accounts. By reducing your taxable income, you can potentially lower your overall tax liability. This can result in significant savings, especially if you are in a higher tax bracket.

How to Use Your FSA for Dental Crowns

Using your FSA for dental crowns is a relatively simple process. First, you’ll need to determine the cost of your dental crown procedure. This can be done by consulting with your dentist or dental insurance provider. Once you have the cost, you can submit a claim to your FSA administrator for reimbursement.

When submitting your claim, be sure to include all necessary documentation, such as receipts or invoices from your dental provider. It’s also important to keep a record of the expenses and reimbursement for your own records and for tax purposes.

Other Ways to Pay for Dental Crowns

If you don’t have an FSA or if your FSA funds are insufficient to cover the cost of your dental crowns, there are other options available to you.

Many dental offices offer financing plans or payment options, allowing you to spread out the cost of your procedure over time. Additionally, some dental insurance plans may cover a portion of the cost of dental crowns, reducing your out-of-pocket expenses.

It’s important to explore all of your options and choose the payment method that works best for you and your financial situation.

Conclusion

In conclusion, using your Flexible Spending Account (FSA) to pay for dental crowns is a viable option. Dental crowns are considered a qualified medical expense and are therefore eligible for FSA reimbursement. By using FSA funds, you can save money on your dental crown procedure and take advantage of the tax benefits associated with these accounts. However, it’s important to check with your FSA administrator and dental insurance provider to confirm eligibility and coverage.

Key Takeaways: Can I Use FSA for Dental Crowns?

- 1. Dental crowns are a common dental procedure used to restore damaged teeth.

- 2. FSA (Flexible Spending Account) can be used to cover the cost of dental crowns.

- 3. FSA funds can be used for a wide range of dental expenses, including crowns.

- 4. It’s important to check with your FSA provider to confirm coverage for dental crowns.

- 5. Using FSA for dental crowns can help you save money on out-of-pocket expenses.

Frequently Asked Questions

Are dental crowns eligible for FSA reimbursement?

Yes, dental crowns are generally eligible for reimbursement through a Flexible Spending Account (FSA). FSAs are pre-tax accounts that allow you to set aside money for qualified medical expenses, including dental treatments. Dental crowns are considered a necessary dental procedure to restore the shape, size, and function of a damaged tooth. However, it’s important to check with your FSA provider or employer to confirm the specific guidelines and requirements for reimbursement.

Keep in mind that while dental crowns are typically eligible for FSA reimbursement, cosmetic procedures may not be covered. If the dental crown is solely for cosmetic purposes, it may not be considered a qualified expense under your FSA. It’s always best to consult with your dental provider and FSA administrator to understand the eligibility criteria and documentation requirements.

What documentation do I need to submit for FSA reimbursement of dental crowns?

To submit a claim for FSA reimbursement of dental crowns, you will typically need to provide documentation that proves the expense is a qualified medical expense. This may include a detailed receipt or invoice from your dental provider, stating the specific procedure performed, the cost of the dental crown, and the date of the treatment.

In addition to the receipt, you may also need to provide a statement from your dental provider explaining the medical necessity of the dental crown. This statement should outline the reasons for the crown, such as tooth damage or decay, and why it is necessary for your oral health. It’s important to keep all documentation related to your dental crown treatment in case of any audit or review by your FSA administrator.

Can I use my FSA for dental crowns if I have dental insurance?

Yes, you can typically use your FSA for dental crowns even if you have dental insurance. FSAs can be used to cover out-of-pocket expenses that are not fully covered by your dental insurance plan. If your dental insurance covers a portion of the cost of the dental crown, you can use your FSA to pay for the remaining balance.

However, it’s important to note that you cannot use both your FSA and dental insurance to pay for the same expense. You will need to coordinate with your dental provider and FSA administrator to ensure proper billing and reimbursement. Your dental provider can provide you with an itemized statement that outlines the portion covered by insurance and the remaining balance that can be paid for using your FSA.

Is there a limit on FSA reimbursement for dental crowns?

The limit on FSA reimbursement for dental crowns may vary depending on your specific FSA plan. It’s important to review the details of your FSA plan to understand any limitations or maximum reimbursement amounts for dental procedures. Some FSAs may have a set dollar amount limit for dental expenses, while others may have a percentage limit based on your total FSA contribution.

Additionally, it’s important to note that any reimbursement from your FSA for dental crowns may be subject to the overall annual contribution limit set by the IRS for FSAs. As of 2021, the maximum annual contribution limit for an individual is $2,750. Be sure to consult your FSA administrator or review your plan documents for specific information on reimbursement limits for dental crowns.

What happens if my FSA reimbursement for dental crowns is denied?

If your FSA reimbursement for dental crowns is denied, it’s important to review the reason for the denial and understand the specific requirements for reimbursement. Common reasons for denial may include incomplete or insufficient documentation, lack of medical necessity, or exceeding plan limits.

If your reimbursement is denied, you can appeal the decision by providing additional documentation or clarification. Consult with your dental provider and FSA administrator to understand the specific steps for appealing a denial. They can provide guidance on what information or documentation may be needed to support your claim and increase the chances of a successful appeal.

[Fort Worth Gentle Dental] Use it or Lose it! / FSA Card (Flex Spending Account Card)

Final Thoughts on Using FSA for Dental Crowns

Dental crowns are a popular solution for restoring damaged or decayed teeth, and they can be quite costly. However, with the help of your FSA, you can alleviate some of the financial burden associated with this dental procedure. By utilizing your FSA funds, you can pay for dental crowns with pre-tax dollars, potentially saving you a significant amount of money.

It’s important to note that FSA funds typically have a “use it or lose it” policy, meaning that any remaining funds at the end of the year may be forfeited. So, if you’re considering getting dental crowns and have an FSA, it’s wise to take advantage of this benefit before the year comes to a close.

In conclusion, using your FSA for dental crowns is a smart financial move. Not only can it help you save money, but it also allows you to take care of your oral health without breaking the bank. So, if you’re in need of dental crowns, don’t forget to tap into the power of your FSA and make the most of this valuable resource. Your smile and

Call or Book appointment online

:Ace Dental Care Alpharetta office: 678-562-1555 - Book Now

Ace Dental Care Norcross office: 770-806-1255 - Book Now

Disclaimer

This blog post was generated by artificial intelligence. The content of this post may not be accurate or complete, and should not be relied upon as a substitute for professional advice. If you have any questions about the content of this post, please contact us.

We are constantly working to improve the accuracy and quality of our AI-generated content. However, there may still be errors or inaccuracies. We apologize for any inconvenience this may cause.