Can HSA Be Used for Dental Crowns?

Dental crowns are a common dental procedure that helps restore the appearance and function of damaged or decayed teeth. They are custom-made caps that cover the entire tooth, providing protection and support. Many people wonder if they can use their Health Savings Account (HSA) to pay for dental crowns. In this article, we will explore the use of HSA for dental crowns and provide valuable information to help you make an informed decision.

What is an HSA?

An HSA, or Health Savings Account, is a tax-advantaged savings account that allows individuals to save money for qualified medical expenses. It is available to those who have a high-deductible health plan (HDHP). Contributions to an HSA are tax-deductible, and the funds can be withdrawn tax-free for eligible medical expenses.

When it comes to dental crowns, the use of an HSA depends on various factors, including the type of dental insurance coverage you have and the specific guidelines set by your HSA provider. Let’s explore some key points to consider.

Dental Insurance Coverage

Coverage Variability

- Varied Coverage: Most dental insurance plans cover a portion of dental crown costs, but the extent varies significantly.

- Review Policy: Essential to review your dental insurance policy to comprehend coverage details and potential out-of-pocket expenses.

HSA as a Supplementary Option

- Limited Coverage Solution: If dental insurance coverage is limited or nonexistent, an HSA proves valuable in offsetting dental crown expenses.

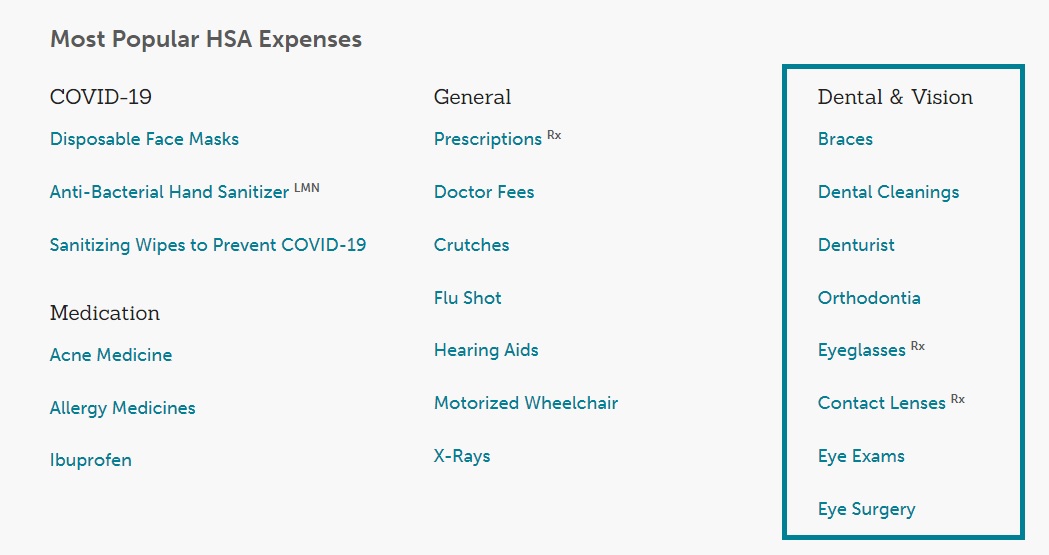

- Versatile Use: HSA funds extend to various medical expenses, including dental treatments.

HSA Guidelines for Dental Crowns

Eligibility and Compliance

- Qualified Expenses: While HSA funds cover dental crowns, adherence to guidelines is crucial.

- IRS List: Dental crowns typically fall within IRS-defined qualified medical expenses eligible for HSA reimbursement.

Record-Keeping

- Documentation Importance: Maintain accurate records and receipts of dental expenses when using HSA funds.

- Consultation Advisable: Seek advice from your HSA provider or a financial advisor to ensure compliance with specific HSA withdrawal rules and regulations.

Key Takeaways: Can HSA Be Used for Dental Crowns?

- 1. Dental crowns can be an eligible expense under an HSA.

- 2. HSA funds can be used to pay for dental crowns if they are medically necessary.

- 3. It’s important to check with your HSA provider to ensure dental crowns are covered.

- 4. HSA funds can be used to cover a portion or the full cost of dental crowns.

- 5. Keep all receipts and documentation for HSA expenses, including dental crowns.

Frequently Asked Questions

1. Can I use my HSA for dental crowns?

Yes, you can use your Health Savings Account (HSA) to pay for dental crowns. Dental crowns are considered a qualified medical expense, which means you can use your HSA funds to cover the cost. However, it’s important to note that not all dental crowns may be eligible for HSA reimbursement.

To be eligible for HSA reimbursement, the dental crowns must be medically necessary, meaning they are needed to restore the function of your teeth or to alleviate pain or discomfort. Cosmetic dental crowns, which are used solely for aesthetic purposes, may not be eligible for HSA reimbursement. It’s best to consult with your dentist and HSA provider to determine if your specific dental crown procedure is eligible.

2. How do I use my HSA to pay for dental crowns?

Using your HSA to pay for dental crowns is a straightforward process. First, ensure that your dental crown procedure is eligible for HSA reimbursement by consulting with your dentist and HSA provider. Then, schedule the dental crown procedure with your dentist.

When it’s time to pay, you can use your HSA funds to cover the cost. You can either use your HSA debit card directly at the dentist’s office or pay out-of-pocket and later reimburse yourself from your HSA account. Keep in mind that you may need to provide documentation, such as receipts or an Explanation of Benefits (EOB), to substantiate the HSA expense.

3. Are there any limitations or restrictions when using HSA for dental crowns?

While you can use your HSA to pay for dental crowns, there may be some limitations or restrictions to keep in mind. For example, your HSA funds can only be used for qualified medical expenses, so if the dental crowns are purely cosmetic, they may not be eligible for HSA reimbursement.

Additionally, HSA funds can only be used for expenses incurred by you, your spouse, or your dependents. If you’re using your HSA to pay for dental crowns for a family member, make sure they meet the eligibility criteria. It’s always a good idea to review your HSA plan documents or consult with your HSA provider to fully understand any limitations or restrictions.

4. Can I use my HSA to cover the cost of dental crown replacement?

Yes, you can use your HSA to cover the cost of dental crown replacement. If your existing dental crown needs to be replaced due to damage or wear, it may be considered a qualified medical expense. You can use your HSA funds to pay for the replacement procedure, as long as it meets the necessary criteria for HSA reimbursement.

As with any dental crown procedure, it’s important to consult with your dentist and HSA provider to ensure that the replacement procedure is eligible for HSA reimbursement. They can provide guidance on the documentation required and any specific guidelines or restrictions that may apply.

5. What happens if I use my HSA for non-eligible dental crown expenses?

If you use your HSA for non-eligible dental crown expenses, you may be subject to penalties and taxes. The IRS imposes strict rules on HSA funds, and using them for non-qualified expenses can result in the funds being considered taxable income.

To avoid any penalties or tax implications, it’s important to ensure that the dental crown expenses you use your HSA for are eligible medical expenses. If you’re unsure about the eligibility of a specific expense, it’s best to consult with your HSA provider or a tax professional.

Understanding Dental Benefits: HSA and FSA | DrJohnsonDDS.com

Final Summary: Can HSA Be Used for Dental Crowns?

The answer to using HSA funds for dental crowns is a definite yes. Dental crowns are considered an eligible expense that can be covered by your Health Savings Account (HSA). Beyond the convenience and flexibility, utilizing your HSA for dental crowns also presents potential tax advantages. By using pre-tax dollars, you can lower your taxable income, offering both oral health benefits and financial advantages. If you require a dental crown, tapping into your HSA proves to be a valuable resource, ensuring both your smile and financial well-being remain in excellent condition. Your HSA funds are designed to support various healthcare needs, including dental treatments, providing a beneficial resource worth utilizing.

Call or Book appointment online

:Ace Dental Care Alpharetta office: 678-562-1555 - Book Now

Ace Dental Care Norcross office: 770-806-1255 - Book Now

Disclaimer

This blog post was generated by artificial intelligence. The content of this post may not be accurate or complete, and should not be relied upon as a substitute for professional advice. If you have any questions about the content of this post, please contact us.

We are constantly working to improve the accuracy and quality of our AI-generated content. However, there may still be errors or inaccuracies. We apologize for any inconvenience this may cause.