Dental crowns are typically covered by Health Savings Accounts (HSAs), which are designed to assist with qualified medical expenses. However, coverage may vary based on your specific HSA plan and the reason for obtaining the crown. It’s recommended to check with your HSA provider to confirm coverage and any limitations. Overall, HSAs can be utilized to support various dental treatments, such as fixing broken or weakened teeth, and understanding the coverage details is crucial for informed decision-making about dental care.

Are Dental Crowns Covered by HSA?

Dental crowns are a common dental procedure that can be necessary to restore a damaged or decayed tooth. Many people wonder if these procedures are covered by their Health Savings Account (HSA). In this article, we will explore the topic of dental crown coverage and provide you with all the information you need to know.

What is an HSA?

A Health Savings Account (HSA) is a type of savings account that allows individuals to set aside pre-tax money to pay for qualified medical expenses. These accounts are typically offered in conjunction with a high-deductible health insurance plan. The funds in an HSA can be used to cover a wide range of medical expenses, including dental procedures.

When it comes to dental crown coverage, it’s important to understand that HSAs typically cover procedures that are considered medically necessary. This means that if it is determined by your dentist that a dental crown is necessary to restore the function and health of your tooth, it may be covered by your HSA. However, if the crown is purely cosmetic and not necessary for the overall health of your mouth, it may not be covered.

Factors that Determine HSA Coverage for Dental Crowns

There are several factors that can influence whether or not a dental crown will be covered by your HSA. These factors include:

1. Medical Necessity: As mentioned earlier, if the dental crown is deemed medically necessary by your dentist, it is more likely to be covered by your HSA. This means that the crown is needed to restore the function and health of your tooth.

2. Insurance Plan: The specific health insurance plan that is paired with your HSA may have its own guidelines and coverage policies for dental procedures. It’s important to review your plan’s documentation or contact your insurance provider to understand what is covered.

3. HSA Balance: The funds available in your HSA can also impact coverage. If you have sufficient funds in your account, it is more likely that the dental crown procedure will be covered.

4. Provider Network: Some HSA plans have a network of providers that participate in the plan. It is important to ensure that your dentist is within the network in order to receive coverage for the dental crown procedure.

It’s important to note that each individual’s HSA coverage may vary depending on their specific plan and circumstances. It is always recommended to review your plan’s documentation and consult with your insurance provider to understand what procedures are covered.

Alternatives to HSA Coverage

If your HSA does not cover dental crown procedures or if you do not have an HSA, there are alternative options for financing your dental crown. These options include:

1. Dental Insurance: If you have dental insurance, it may provide coverage for dental crown procedures. It’s important to review your policy and understand the coverage limits and any out-of-pocket expenses.

2. Payment Plans: Many dental offices offer payment plans to help patients finance their dental procedures. These plans allow you to spread out the cost of the dental crown over a period of time, making it more affordable.

3. Financing Options: There are third-party financing options available specifically for dental procedures. These options allow you to borrow the necessary funds for the dental crown and make monthly payments with interest.

4. Personal Savings: If you have personal savings set aside, you can use these funds to pay for the dental crown procedure.

While HSA coverage can be a convenient way to finance dental crown procedures, it is not the only option available. Exploring alternative financing options can help ensure that you receive the dental care you need.

Conclusion

In conclusion, whether or not dental crowns are covered by your HSA depends on several factors, including medical necessity, insurance plan policies, HSA balance, and provider network. It’s important to review your plan’s documentation and consult with your insurance provider to understand what procedures are covered. If your HSA does not cover dental crown procedures, there are alternative financing options available. Remember to prioritize your dental health and explore all available options to receive the necessary care. So, if you are considering getting a dental crown and have an HSA, make sure to do your research and consult with your insurance provider to determine your coverage options.

Key Takeaways: Are Dental Crowns Covered by HSA?

- Dental crowns may be covered by an HSA (Health Savings Account).

- Check with your specific HSA provider to understand their coverage policies.

- Some HSA plans may require a letter of medical necessity from your dentist.

- Be sure to keep all receipts and documentation for HSA reimbursement.

- Consult with your dentist to determine if a dental crown is necessary for your oral health.

Frequently Asked Questions

Are dental crowns covered by HSA?

Many people wonder if dental crowns are covered by their Health Savings Account (HSA). The answer to this question depends on various factors, such as the type of HSA plan you have and the reason for getting a dental crown.

In general, dental crowns may be covered by HSA if they are deemed medically necessary. This means that if your dentist determines that a dental crown is required for the health and functionality of your teeth, it may be eligible for coverage. However, if the dental crown is considered purely cosmetic, it is unlikely to be covered by HSA.

How can I find out if my dental crown is covered by HSA?

To determine if your dental crown is covered by your HSA, it is best to reach out to your HSA provider directly. They will be able to provide you with detailed information about your specific plan and coverage. You can usually find their contact information on their website or on your HSA account portal.

When contacting your HSA provider, be prepared to provide them with the details of your dental treatment, including the reason for the dental crown and any supporting documentation from your dentist. They will review this information and let you know if the dental crown is eligible for coverage under your HSA.

What are the alternatives if dental crowns are not covered by HSA?

If your dental crowns are not covered by your HSA, there are still alternative options to consider. One option is to check if your dental insurance covers dental crowns. Dental insurance plans often have specific coverage for restorative procedures like dental crowns.

If you do not have dental insurance or if your dental insurance does not cover dental crowns, you may want to explore other financing options. Some dental offices offer payment plans or financing options that can help make the cost of dental crowns more manageable. Additionally, there are third-party financing companies that specialize in dental expenses.

Can I use my HSA for dental crown maintenance?

While HSA funds can typically be used for medical expenses, including dental care, the coverage for dental crown maintenance may vary. Routine maintenance, such as regular cleanings and check-ups, is generally covered by HSA. However, specific maintenance procedures related to dental crowns, such as adjustments or repairs, may not be covered.

It is best to consult with your HSA provider or dental insurance company to understand the coverage for dental crown maintenance. They can provide you with detailed information about what is eligible for reimbursement and any limitations or exclusions that may apply.

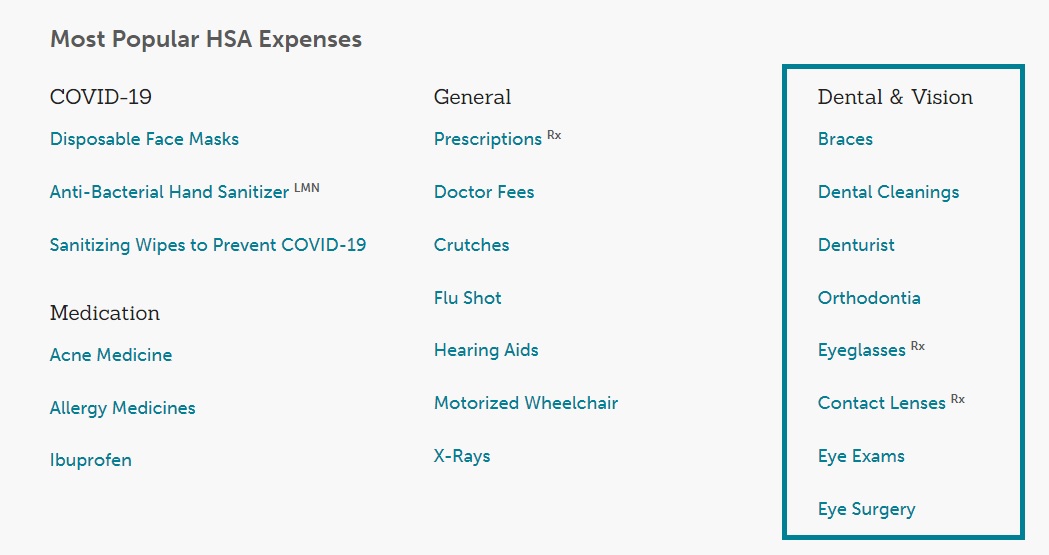

What other dental procedures are typically covered by HSA?

HSA plans typically cover a range of dental procedures that are deemed medically necessary. Some common dental procedures that are often covered by HSA include fillings, root canals, extractions, and periodontal treatments. These procedures are considered essential for maintaining oral health and functionality.

However, it is important to note that coverage may vary depending on your specific HSA plan. It is always recommended to review your plan documents or contact your HSA provider to understand the exact coverage for dental procedures.

Understanding Dental Benefits: HSA and FSA | DrJohnsonDDS.com

Final Thoughts on Dental Crowns and HSA Coverage

Call or Book appointment online

:Ace Dental Care Alpharetta office: 678-562-1555 - Book Now

Ace Dental Care Norcross office: 770-806-1255 - Book Now

Disclaimer

This blog post was generated by artificial intelligence. The content of this post may not be accurate or complete, and should not be relied upon as a substitute for professional advice. If you have any questions about the content of this post, please contact us.

We are constantly working to improve the accuracy and quality of our AI-generated content. However, there may still be errors or inaccuracies. We apologize for any inconvenience this may cause.